Needing to submit an SR-22 is no one's idea of fun. You'll pay greater car insurance policy premiums than a motorist with a clean document and you'll be restricted in your selection of insurers. However searching for the least expensive rates can aid. Here's what you require to understand - insurance. See what you might save money on automobile insurance, Quickly compare individualized rates to see just how much changing vehicle insurance coverage might conserve you.

You might be required to have an SR-22 if: You've been convicted of DUI, Drunk driving or one more major relocating offense. You've triggered an accident while driving without insurance.

For sure sentences in Florida as well as Virginia, you may be bought to file a comparable form called an FR-44. This requires a higher degree of liability insurance coverage than the state's minimum. Not all states need an SR-22 or FR-44. If you need one, you'll discover out from your state department of automobile or traffic court.

When you're alerted you need an SR-22, start by calling your car insurer. Some insurance companies do not offer this solution, so you might require to look for a business that does. If you don't already have automobile insurance coverage, you'll possibly require to get a plan in order to get your driving advantages recovered - credit score.

Just how much greater depends upon where you live and also what offense resulted in your SR-22. Insurance quotes will certainly also differ relying on what automobile insurance provider you pick. To obtain the best rate for you, it is very important to contrast rates from multiple insurance companies. See what you could minimize vehicle insurance, Quickly compare tailored prices to see just how much switching cars and truck insurance coverage can conserve you.

How What Is Sr-22 Insurance - Nextadvisor With Time can Save You Time, Stress, and Money.

Area issues. As an example, consider a vehicle driver with a current drunk driving, a violation that could cause an SR-22 requirement. Nerd, Wallet's 2021 price analysis located that out of the nation's 4 largest companies that all submit an SR-22, insurance policy prices typically were least expensive from Progressive for 40-year-old vehicle drivers with a current drunk driving.

When your demand ends, the SR-22 doesn't instantly drop off your insurance coverage policy. Make certain to allow your insurance coverage firm know you no longer require it (sr22 insurance).

Rates typically continue to be high for 3 to 5 years after you have actually triggered a mishap or had a relocating infraction. If you search just after the three- as well as five-year marks, you may discover reduced costs (sr-22 insurance).

Obtain in touch with your insurance policy carrier to locate out your state's present requirements and make certain you have appropriate coverage. How long do you require an SR-22? A lot of states call for chauffeurs to have an SR-22to verify they have insurancefor regarding three years.

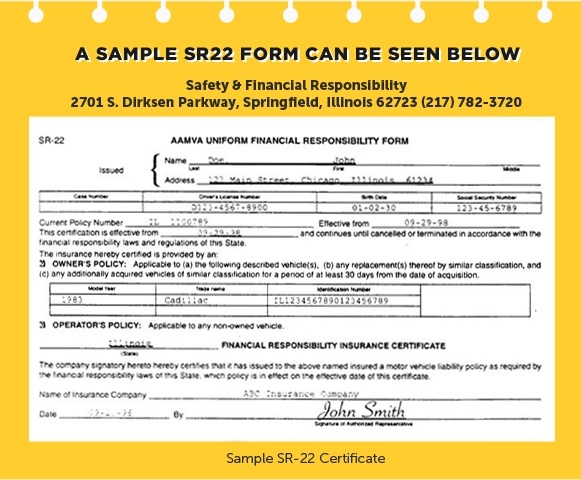

What is an SR-22? An SR-22 is a certification of financial obligation required for some vehicle drivers by their state or court order. An SR-22 is not a real "kind" of insurance policy, however a kind submitted with your state. This form serves as proof your vehicle insurance coverage policy meets the minimal liability protection needed by state legislation.

Our Bmv: Licenses, Permits, & Ids: Proof Of Financial Responsibility Diaries

car insurance sr22 coverage insurance sr22 insurance

car insurance sr22 coverage insurance sr22 insurance

Do I require an SR-22/ FR-44?: DUI sentences Negligent driving Mishaps triggered by without insurance vehicle drivers If you require an SR-22/ FR-44, the courts or your state Motor Vehicle Division will certainly alert you.

Is there a charge linked with an SR-22/ FR-44? This is an one-time cost you need to pay when we submit the SR-22/ FR-44.

A declaring cost is charged for every private SR-22/ FR-44 we submit - no-fault insurance. For instance, if your partner is on your plan and both of you require an SR-22/ FR-44, then the declaring cost will be billed twice. Please note: The charge is not included in the price quote because the declaring fee can differ.

The length of time is the SR-22/ FR-44 valid? Your SR-22/ FR-44 ought to be valid as long as your insurance plan is active. If your insurance coverage is terminated while you're still required to lug an SR-22/ FR-44, we are required to inform the proper state authorities. If you don't keep continual insurance coverage you could shed your driving opportunities.

Do not worry, we got this. Convenient filing. Obtained a letter from the State of Illinois to validate your insurance coverage?

A Biased View of Sr-22 Car Insurance Basics

Immediate SR-22 Insurance Filing If your certificate has been put on hold, revoked, or you've had a DUI, a might be required to renew your driving opportunities. Need SR22? When you obtain a policy with Insure on the Spot, a record is sent to the state validating that you have insurance coverage.

To blame Mishaps, Depending upon the severity of a crash, if you have actually been located to blame for a crash, you may likewise be purchased by the courts to maintain an SR-22 for a set period of time. Multiple Violations, Those that rack up several smaller web traffic violations in a brief time period might need to file an SR22.

Just How Does SR-22 Insurance policy function? You may have problems if your agency is not certified in the state requesting an SR-22 certification (motor vehicle safety).

Living in a various state does not mean your SR-22 demands vanish. If your insurance provider is not accredited in the state asking for the SR-22, you will certainly need to directly submit the SR-22 type with that state's DMV.If the procedure is frustrating, get in touch with the state's Department of Electric motor Cars or your agent for assistance on your state's needs.

The Only Guide to Click here to find out more Sr22 Insurance: Cost & Cheap Sr-22 Insurance Quotes - 101

SR22 Insurance Expenses, Just how much an SR-22 declaring prices varies by state. Motorist's normally pay around a $25 declaring charge for filing SR-22 insurance coverage. This can fluctuate by state and the insurance coverage supplier. An SR-22 is relatively low-cost and gets attached to your preexisting policy. auto insurance. If you are gone down from your supplier or never had cars and truck insurance coverage, you have some choices to make when it concerns locating the finest protection prices.

Satisfying your state's demands must be a concern, yet you desire to locate a quote with a policy that is cost effective. Will an SR-22 plan affect my insurance price?

Constantly be planned for higher coverage rates after the filing. How to Lower Automobile Insurance Coverage Rates After an SR-22 plan, Your auto insurance coverage costs are bound to raise following an SR-22 demand and also you're mosting likely to want to find a method to decrease them. While they may never ever be as low as they were pre-SR-22, there are still some means to make them suit your budget better (sr-22 insurance).

bureau of motor vehicles insurance coverage credit score dui liability insurance

bureau of motor vehicles insurance coverage credit score dui liability insurance

sr-22 insurance sr22 coverage bureau of motor vehicles motor vehicle safety sr-22 insurance

sr-22 insurance sr22 coverage bureau of motor vehicles motor vehicle safety sr-22 insurance

The higher your deductible is, the much less your insurance policy premiums will be. It is essential to bear in mind that when you establish your deductibles at a certain amount, you need to make certain that you can in fact pay it following an accident.

High-powered, luxury automobiles are a lot more pricey to insure than your everyday sedan. More recent designs likewise tend to be a lot more expensive to cover than decades-old cars. It's useful to go shopping around and profession in your vehicle for one that's a number of years of ages with excellent safety rankings. You will certainly seem much less of an insurability danger to your insurance policy service provider.

The Basic Principles Of Best Sr-22 Insurance Options For 2022 - Benzinga

If you are still displeased with your insurance premiums, ask your insurance coverage representative concerning any type of discount rates you are qualified for - auto insurance. Representatives are well informed of the basics of all sort of price cuts you can obtain. Terminating or Removing Your SR-22 Protection, Also if you are certain your SR-22 duration is up, calling your states Division of Electric motor Autos or DMV validating that is an excellent idea.

Bring only the state minimum coverage will usually not be adequate when you require an FR-44. This, subsequently, will increase your automobile insurance prices. An FR-44 certification is needed for three years typically, as well as it also can not be terminated prior to the expiry day. SR-22 Regularly Asked Questions, Are there various sorts of SR-22s? There are 3 choices when acquiring an SR-22 certificate from your insurer, Proprietor, Driver, as well as Owner-Operator (insurance companies).

Operator - An Operator's SR22 Type is for drivers that borrow or lease an automobile as opposed to owning one - no-fault insurance. This may also be combined with non-owner SR-22 insurance coverage and can use a less costly alternative if it's tough covering the cost of an SR-22. Operator-Owner - The Operator-Owner's SR22 Kind is planned for drivers that both have a vehicle however occasionally, rent or obtain one more car.

deductibles liability insurance sr22 coverage liability insurance liability insurance

deductibles liability insurance sr22 coverage liability insurance liability insurance

You additionally can not only purchase an SR-22 certification. It goes together with your car insurance plan. Just How Can I Locate The Cheapest SR22 Insurance Near Me? The finest method to find affordable SR22 insurance near you is by shopping about and also obtaining quotes. This is important when you are obtaining any kind of insurance plan however particularly important for SR22s - sr-22 insurance.

National insurer are not eager to offer protection for a person that needs SR22 insurance. You might have better good luck with local companies as they frequently will certainly cover risky vehicle drivers, which you will certainly be taken into consideration with your SR22 demand. Be sure to get SR22 quotes from every insurance policy business you encounter and assess all the SR22 plans offered on the marketplace. sr22.

8 Easy Facts About What Is Sr22 Insurance? – Your Guide To Sr-22 ... - Way Shown

Does SR-22 Insurance Policy Cover Any Car I Drive? Yes, your SR22 insurance policy will cover any kind of car you drive so long as you have owner-operator SR22 insurance policy - dui. An owner-operator SR22 certificate is a kind of SR22 kind that enables you to drive any type of vehicle, despite who owns it, and still be identified as an insured chauffeur with a valid SR22.

driver's license vehicle insurance sr-22 credit score deductibles

driver's license vehicle insurance sr-22 credit score deductibles

Owner SR22 insurance policy is an SR22 type that just permits you to drive vehicles that you own. Non-owner SR22 insurance policy is the most inexpensive choice yet is just for individuals who do not possess a car yet they often drive, whether it be from renting out or borrowing a person else's cars and truck. It depends upon what your automobile ownership condition is when it pertains to whether your SR22 will certainly lug over to lorries you drive.